Understanding the extra costs of buying a home in Australia

Buying a home in Australia is an exciting step, but it's important to be aware of the extra costs associated with the process. Whether you're a new home buyer or someone unfamiliar with Australian property transactions, this guide will help you understand the additional expenses you'll need to cover.

Disclaimer: The information provided in this post is for general informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, it is essential to remember that real estate transactions can be complex, and individual circumstances may vary. For specific decisions related to your property purchase, we strongly recommend consulting with a qualified solicitor or a financial advisor who can provide personalized guidance tailored to your unique situation.

1. Stamp duty: Your largest upfront cost

One of the most significant upfront costs you'll face when buying a property in Australia is Stamp Duty. The amount you pay varies from state to state and depends on the property's value. Some states offer thresholds and concessions. For instance, in certain states, a purchase under $500,000 may be exempt from Stamp Duty. However, if you're buying a property valued at $800,000, you might have to pay Stamp Duty, which could range from $20,000 to $30,000. Keep in mind that Stamp Duty rates can change, and it's essential to stay updated on the latest regulations, like those coming into effect in New South Wales from January 15, 2023.

2. Other government costs

Apart from Stamp Duty, there are other government costs to consider:

- Mortgage registration and title registration fees: These fees typically range from a couple of hundred dollars to a few thousand dollars, depending on the property's value.

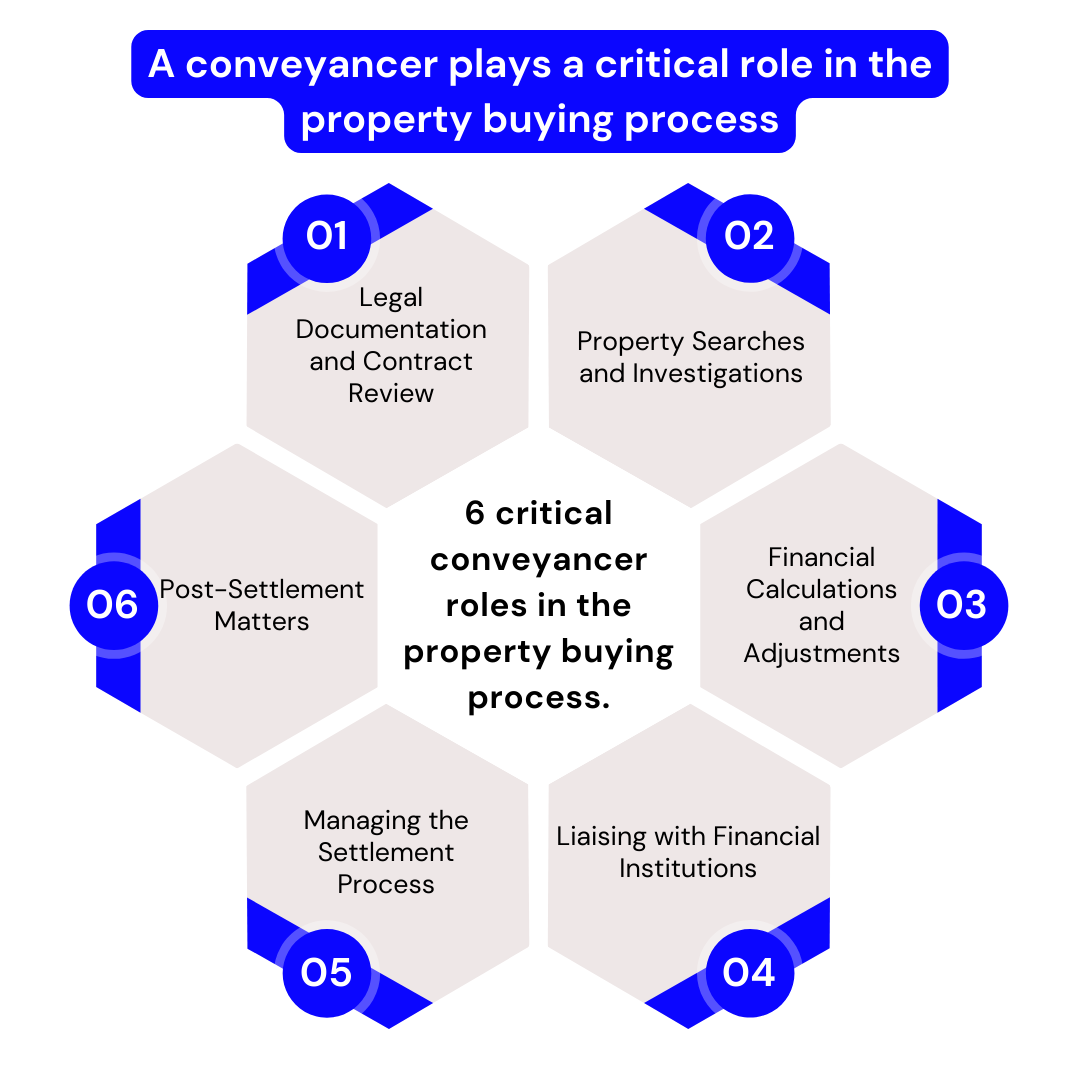

3. Solicitor fees

When buying a property, you'll need to engage a solicitor, and their fees can range from $1,000 to $2,500. The exact cost may vary depending on the specific services you require, such as property searches. It is strongly recommended to work with a highly rated solicitor as buying a property is perhaps the biggest financial decision of your life and shall be taken seriously.

4. Building and pest inspection fees and strata note inspection

It's essential to get a building and pest inspection to ensure the property is in good condition. Budget around $500 for $2000 for this crucial step, depending on the size of the property. Make sure you engage an independent highly rated inspector. You certainly don't want to face surprises that may cost you hundreds of thousands of rectification works after you've just cleared your bank account for paying the deposit. You also want to make sure what has been happening with the strata if you are buying into a strata scheme. There is useful information such as if any major works are planned and how much the strata currently have in their balance sheet in both the administration fund (you may hear admin fund) and capital works fund (previously called a 'sinking fund'). Furthermore you seriously want to know details of whether there has been any disharmony in the building with regards to violation of any by-laws which may or may not have led into a NCAT or VCAT.

5. Other costs: Adjustments on settlement

Additional costs can arise on settlement day. These expenses often involve adjustments for items like Council rates, water bills and strata fees, ensuring a fair distribution of costs between the buyer and the seller for any overlap in billing periods.

6. Costs added to your loan

Several costs can be added to your loan:

- Lenders Mortgage Insurance (LMI): If you don't have a 20% deposit or don't qualify for a mortgage insurance waiver, you'll be required to pay for Lenders Mortgage Insurance. It's essential to check if you're eligible for any waivers, such as the Home Guarantee Scheme, or if your profession offers mortgage insurance waivers.

Final notes

By understanding these costs, you'll be better prepared to navigate the home buying process in Australia. The journey to home-ownership can be complex, but having a clear picture of the expenses involved is a crucial step.

What will be in our next blog posts

In addition to the financial aspects, we'll guide you through the entire home buying process in Australia. So far, we've covered the extra cost that you should take into account on top of the property price. Stay tuned for our next blog posts about determining your budget, including your deposit, borrowing capacity, and the costs associated with your purchase.